Buying a home with terrible credit

Those include buying an energy-efficient home having very good credit scores showing conservative use of credit or having substantial savings balances. With a credit score as low as 500 you can obtain FHA financing through an approved lender but be prepared to put down 10 percent as a down payment.

How To Buy A House With Bad Credit In 2022 Tips And Tricks

This is also the time to see your credit report.

. Start Saving for Your Down Payment. However for people with a bad credit score the majority of. 500 minimum credit score FHA loans date back.

I am working on rebuilding my credit via a credit card and paying on my student loans. The first step to buying a home is to have the money sufficient to make the purchase in the first place. You can prequalify for a bad credit home loan from Bank of America Mortgage without cost or commitment.

If you have a gross. How To Buy a House With Bad Credit You can make yourself a better credit risk in the eyes of potential lenders by setting the numbers up in your favor. Consumers with poor credit ie FICO scores below 600 within a 300 to 850 range can access mortgage loans but may have to pay higher interest rates.

It requires home buyers to have a minimum credit score of 620 at the time of purchase. However I have a lot of. Find the right loan and lender Investigate all your mortgage.

I have terrible credit 498 and I would like to buy a home in the next 2 - 3 years. The application process which it calls the Digital Mortgage. FHA loans may allow lower credit scores in the 500 range.

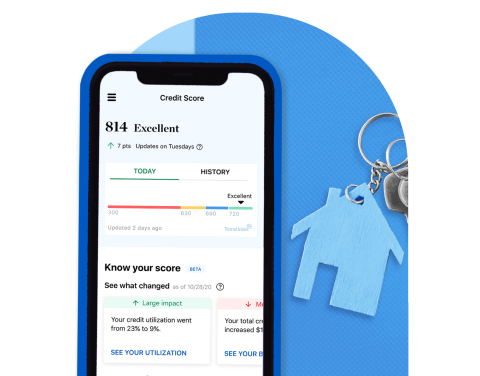

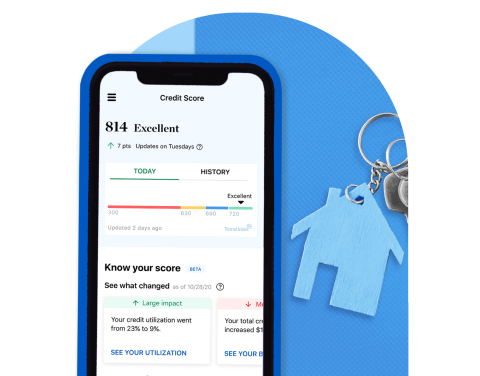

FICO scores ranging from 670 to 799 are. Keep your credit utilization ratio low which means dont run up a balance of. A FICO score between 580 and 669 is considered fair meaning its below the average credit score of most US.

Make all future payments on time and in full. It will list any payments youve missed and give you an idea of your credit score. Check your credit record.

After repairing bad credit the next best thing to do when preparing for a home purchase is to boost your savings. Typically the minimum credit score requirement for buying a house is between 500-620 depending on the type of loan. Check credit reports look for mistakes and correct errors if necessary.

You can then work to. The agency approves borrowers with a credit. Federal Housing Administration FHA Loan Applying for an FHA loan is the easiest way of buying a house with bad credit.

Conventional borrowers who barely make the credit score cut-off will usually need a debt-to-income ratio no higher than 36 and must be buying the home as their primary. If you want to buy a house with no credit a manual underwriter is much more likely to approve your application.

Money Is A Terrible Master But An Excellent Servant P T Barnum Barnum Master Servant

Minimum Credit Scores For Fha Loans

How To Get A Mortgage With Bad Credit Bad Credit Mortgage Loans For Bad Credit Bad Credit

Finding Home Loans With Bad Credit Yes You Can

How To Buy A House With Bad Credit In 2022 Tips And Tricks

How To Buy A House With Bad Credit Nerdwallet

Pin On Products

The Reality Of Bad Credit When Buying A Home Bad Credit Home Buying Improve Your Credit Score

Pin On Credit Repair

How To Buy A House With Bad Credit American Financing

Repair Your Credit How I Fixed Mine And Bought A House Credit Repair Fix Bad Credit What Is Credit Score

How To Get A Bad Credit Home Loan Lendingtree

Mortgage Broker City Real Estate Wholesale Real Estate Real Estate Investing

Hugedomains Com

![]()

How To Get A Mortgage With Bad Credit Bad Credit Mortgage Loans For Bad Credit Bad Credit

How To Buy A House With Bad Credit Nerdwallet

Pin On Reverse Mortgage Colorado